Experience the power of Ethoca's collaboration network

Experience the power of the Ethoca network

For years, there was no fast, reliable and secure way to share payments intelligence outside of the chargeback process. We changed all that with the first-and-only network of its kind that closes costly information gaps across the purchase journey.

Real-time information sharing offers a powerful new way to prevent fraud and reduce transaction disputes, while creating more engaging customer experiences. Welcome to the Ethoca network — the opportunities are endless. Our network connects thousands of the world’s largest merchants, issuers and technology partners across the globe to enable better data sharing.

We can help you...

Fight first-party fraud

Reduce the impact first-party fraud has on your business

Prevent chargebacks

Save valuable time and money

Reduce CNP fraud

Reduce CNP fraud and improve your bottom line

Smart Subscriptions

Create a streamlined subscription management experience

Our solutions

Ethoca Consumer Clarity™

Ethoca Alerts

How we help merchants

Learn more about how Ethoca's collaboration network can help merchants reduce disputes and chargebacks while building better customer experiences.

How we help issuers

Find out how Ethoca can help issuers enhance their digital and back office channels and elevate customer experiences while minimising the impact of disputes.

How we help partners

Whether you're a merchant or issuer service provider or a fraud prevention platform, partnering with Ethoca will help enhance your product offering.

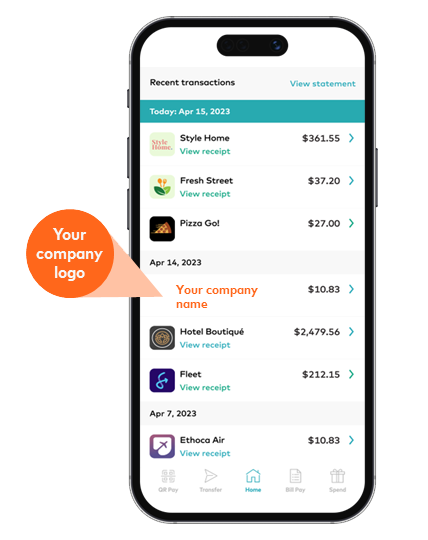

Merchants, do more with your brand!

Your logo is a symbol of everything your business stands for. It's also a clear visual cue that your customers recognise and trust.

Thanks to collaborations with leading financial institutions, we’ve transformed your logo into a powerful tool that gives consumers clarity around what they bought and who they bought it from. The goal? Extend your brand presence while eliminating transaction confusion, a leading cause of costly chargebacks.

The brink of transformation: What's next for digital banking?

Our latest research suggests we’re on the brink of major shifts in consumers’ attitudes, beliefs, and habits. These changes will propel the upcoming wave of digital banking innovations that will address unmet needs. The next iteration of tools and solutions must offer a compelling next-gen experience if businesses want to win new customers while also enhancing operations and driving better financial performance.