Fraud Insights for Merchants

Fraud Insights for Merchants provides you with a complete view of fraud, chargeback and decline data across your entire Mastercard portfolio — available in both a web-based dashboard and a transaction-level data format.

Get a 360-degree view of your fraud data

This rise in fraud, false declines and chargebacks has created increased risk, lost opportunities and greater costs for merchants. As cybercrime grows in sophistication, merchants face an increasingly diverse and complex fraud landscape — leading to projected losses in the hundreds of billions. Fraud Insights for Merchants is a centralised source of Mastercard fraud, chargeback and decline data.

Data options

Fraud

Understand the origins of fraud by Business Identification Number (BIN), region and country, and 3DS impact

Declines

See what’s causing declines by reason code, BIN, issuer country, value and volume

Chargebacks

Understand what’s causing chargebacks, including fraud vs. non-fraud, reason codes and BIN

Delivery formats

Dashboard portal

View all fraud data and trends through an easy-to-understand, interactive, web-based portal

Transaction-level data

Access fraud data in a consistent format that can be used for further analysis or to supplement existing fraud models

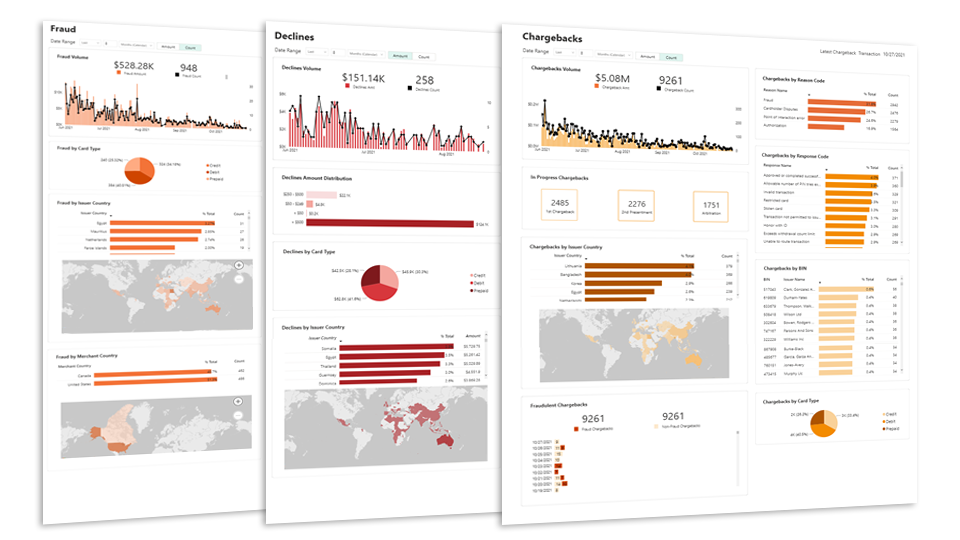

Dashboard view

See your fraud, chargeback and decline data broken down by country, region, value and volume totals, card type, bank identification number (BIN) and more.

Benefits to merchants

Complete view

Get a complete view of your fraud, chargeback and false-decline metrics across your entire Mastercard portfolio.

Reduced costs

Update fraud prevention and control operations to minimise the costs associated with fraud and chargebacks while improving acceptance rates for good transactions.

Increased efficiency

Gain insights that can help you adjust your fraud operations and strategy, saving you time while enabling you to monitor the impact of any change — including monitoring 3DS impact.

Improved customer experience

Leverage these insights to build better customer journeys with minimised fraud and purchase friction.

How a convenience retail merchant group reduced fraud and declines.

With Fraud Insights for Merchants, a convenience retailer was able to get a complete view of fraud occurring in their network. This enabled them to isolate instances of fraud occurring at individual stores daily. Access to fraud and decline data helped them analyse the causes of declines, allowing them to close any loopholes used by fraudsters who would often target specific store locations - reducing their losses and chargebacks.